Briefing highlights

- Economic outlook is brighter

- OECD projects ‘stable’ growth

- Stocks, Canadian dollar, oil at a glance

- Markets await Trump trade speech

- Nissan cuts outlook

- Huawei hands out bonuses

- Required Reading

Half-full

Make no mistake: Uncertainty abounds.

But many analysts now paint a picture of a glass half-full when it comes to the economic and market outlook.

"At long last we can speak a bit more confidently about potential upside risks to the growth outlook," said Bank of Montreal chief economist Douglas Porter.

First, Mr. Porter said in his recent report, there’s a truce in the “dangerous” U.S.-China trade war, and the situation could get better going forward.

Second, the likelihood of a Brexit "crash-out" has eased, though a "massive question mark" hangs over it.

And third, the U.S. Federal Reserve has “stabilized sentiment” and helped buoy U.S. housing with its series of interest-rate reductions.

"Record equity markets and more normal bond markets are sending positive signals," Mr. Porter added.

“And, we would point out that the consensus on U.S. growth for 2020 has actually been nudged higher in the past month – albeit by just a tenth to 1.8 per cent, according to the Blue Chip Survey.”

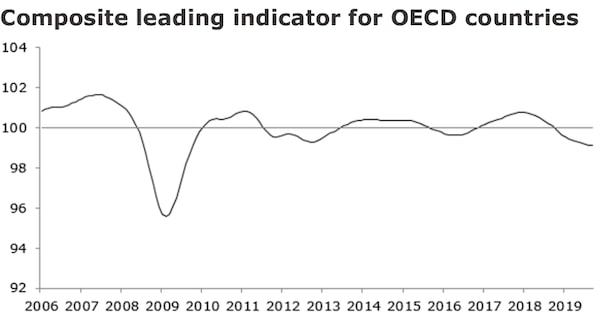

Today, the Organization for Economic Co-operation and Development released its composite leading indicators, or CLIs, for the OECD group and individual economies.

These indicators, which suggest “turning points” six to nine months down the road, “continue to anticipate stable below-trend growth momentum in the OECD area as a whole.

Note the stable there, though, yes, also below-trend growth.

Source: OECD

“Within OECD economies, stable growth momentum remains the assessment for France and Canada, and is now also anticipated in Japan and Italy, with similar signs now also emerging in the euro area as a whole,” the group said.

“On the other hand, the CLIs for the United States and Germany continue to point to easing growth momentum, which is now also the assessment for the United Kingdom, although large margins of error persist due to continuing Brexit uncertainty.”

The OECD indicators also projected “stable growth momentum” in China’s industrial sector, Brazil and Russia.

There are many potential potholes, obviously, prime among them the U.S. trade policy that has driven markets down and up depending on tweets and headlines.

In Canada, the central bank is worried about those global trade issues and, at home, still has a close watch on housing and mortgage markets.

What might all this mean?

“For the time being, markets are still priced for significant chances of a rate cut by the Bank of Canada over the next year, and one more trim from the Fed,” Mr. Porter said.

"But, if the recent trend of better news on many fronts persists into year-end, one can only wonder how long before markets begin to lean the other way on the rate front through 2020."

Here's a look at what analysts are thinking, gathered from comments over the past few days:

“Given Q3 national accounts data from early-reporting countries and monthly data from other economies, it looks like world GDP growth actually picked up a touch last quarter to just over 3% annualized. And there have been some encouraging signs about the health of the world economy at the start of Q4.” Global economist Simon MacAdam, assistant economist Bethany Beckett and research assistant Olivia Cross, Capital Economics

“It’s still too early to close the books on 2019, or the trends that defined the year. Recent data haven’t fully dispelled fears of a downturn, and a breakdown in U.S.-China trade talks resulting in further tariff hikes remains a risk – one that might have central banks contemplating further easing. But at this point we don’t expect this year’s lows in government bond yields to be re- tested, and look for yields to move higher in 2020.” Josh Nye, senior economist, Royal Bank of Canada

“Data continue to confirm that U.S. recession risks have been overstated in recent months and that the ~2-per-cent expansion in real activity continues. [Institute for Supply Management] non-manufacturing convincingly rebounded to 54.7 from 52.6. Fed speakers were on message that the economy is ‘in a good place.’ Equity prices rallied and Treasury yields obtained multi-month highs on headlines that the U.S. might roll back some China tariffs.” Andrew Hollenhorst, chief U.S. economist, Igor Cesarec, research economist,, and Veronica Clark, associate, U.S. economics, Citigroup

“One of the most important market indicators we have been focusing on over the past two years was the inversion at the front end of the yield curve. Last year, we had argued that the inversion at the front end of the U.S. yield curve, since it first emerged in April 2018 between the 2- and 3-year forward points of the [one-month overnight index swap, or OIS] rate, had been an important market signal pointing to downside risk for equity and risky markets more broadly. ... A sea change has taken place over the past few weeks with this indicator, i.e. the spread between the 1- and 2- year forward points of the U.S. OIS curve, improving rapidly and turning positive [last] week for the first time in a year. Not only does this suggest that this previously bad omen for risky markets is gone, but it also implies that markets are moving away from pricing in end-of-cycle dynamics. ... As a result, risk premia related to U.S. recession or end-of-cycle dynamics are gradually priced out.” Nikolaos Panigirtzoglou, global market strategist, JPMorgan Chase

“We still expect [U.S.] GDP growth to slow a little further in the fourth quarter, but the recent stabilization in the activity surveys, along with the growing prospect of a meaningful trade truce with China, suggest that the prospects for the economy next year are starting to improve.” Andrew Hunter, senior U.S. economist, Capital Economics

For Canada, in particular, it's not all hunky-dory, and economists have been cutting their projections for third-quarter growth. However, as Citigroup's Ms. Clark and Mr. Hollenhorst put it, "November brings darker days but [a] brighter outlook."

They have cut their "tracking" of third-quarter growth in Canada to an annual pace of 1.5 per cent.

Here's more on that score:

“Market pessimism over the outlook for global growth further subsided [last] week, as a ‘phase 1’ trade deal between the U.S. and China, with the potential for tariff rollbacks, looks increasingly likely. With few other global or domestic developments, risk-on sentiment sent Canadian yields higher with global yields, although the Canadian dollar continued to weaken with broader U.S. dollar strength. Although a deal has yet to be finalized and general uncertainty remains, a deescalation of trade tensions will still be positive for the outlook for Canada.” Citi’s Ms. Clark and Mr. Hollenhorst

“Early signs of a bottoming out in manufacturing sentiment and potential for a U.S.-China trade deal suggests key external headwinds could begin to subside. But the global industrial sector remains weak, and even if further tariff hikes are avoided, we could see more spillover into Canada. The [Bank of Canada’s] latest business outlook survey showed investment intentions remain healthy amid rising capacity constraints outside of the energy-producing provinces. But those intentions haven’t translated into actual capital spending so far this year. Low borrowing costs don’t seem to be enough to offset persistent trade uncertainty, or more structural issues like competitiveness and burdensome regulation.” RBC’s Mr. Nye

“The big picture is that housing remains on the mend [in Canada] after a couple tough years, but the same can’t be said of trade. The merchandise deficit did narrow somewhat in September to just under $1-billion, but only because imports fell more than exports. Both sides of the ledger are down slightly from year-ago levels, and it now looks like net exports carved into overall GDP growth in Q3. We’re still calling for 1.4-per-cent GDP [growth] in the quarter, with housing and government spending the lone sources of strength, such as it is.” BMO’s Mr. Porter

“Despite strong second-quarter growth, Canada’s economy may be headed toward a slowdown triggered by a cooling of international trade. However, the picture remains murky. Year-ago per-cent changes in exports fell four months in a row through September. Imports have displayed a similar pattern, with the exception of a 1.1-per-cent uptick in August. While a four-month stretch of slowing trade on its own is nothing to worry about, the sources of the slowdown - trade tensions and falling global growth - are cause for concern and a harbinger of prolonged economic cooling.” Brendan Meighan, senior economist, Moody’s Analytics

Read more

- David Parkinson: Bank of Canada acknowledges it lacks options to lead economy out of potential recession

- David Rosenberg: Numbers show the U.S. is closer to a recession than you think

- David Parkinson: Canada trade deficit narrows to $978-million in September, but imports fall faster than exports

- David Parkinson: Canada’s GDP increases only slightly as global pressures mount

- David Parkinson: Bank of Canada holds rates steady but sounds note of caution as global worries mount

Markets at a glance

Read more

Ticker

Britain sheds jobs

From Reuters: Britain’s employers cut the most jobs in over four years between July and September, according to official data that highlighted how the labour market is slowing, just as an election nears. The hitherto strong labour market has been a silver lining of the Brexit crisis as companies hired workers that they can lay off later, if needed, rather than make longer-term commitments to investment. The Office for National Statistics said the number of people in employment fell by 58,000. The unemployment rate fell back to 3.8 per cent, its lowest level since early 1975 during the third quarter.

Nissan cuts outlook

From Reuters: Nissan Motor Co. reported a 70-per-cent profit drop and cut its full-year outlook to an 11-year low, as the Japanese auto maker was hit by falling sales that highlight its ongoing turmoil after the ouster of former head Carlos Ghosn. Operating profit at Japan’s second-biggest auto maker by sales came in at ¥30-billion during the July-September period versus ¥101.2-billion a year earlier. Nissan cut its full-year operating profit forecast by 35 per cent to ¥150-billion.

Embraer slides to loss

From Reuters: Brazilian plane maker Embraer reported a third-quarter loss and signalled it may issue a smaller dividend to shareholders after it finalizes a US$4.2-billion commercial passenger jet deal with Boeing, which faces regulatory hurdles. Embraer said it now expects the dividend to range between US$1.3-$1.6-billion, compared with previous guidance of US$1.6-$1.7-billion, the company said in a securities filing. Embraer reported a third-quarter loss of US$77.2 million, affected by costs related to the transaction with Boeing.

German investor sentiment improves

From Reuters: The mood among German investors improved more than expected in November, a ZEW survey showed, with the research group pointing to a more favourable outlook for Europe’s biggest economy after recent developments in trade conflicts. “There is growing hope that the international economic policy environment will improve in the near future, which explains the sharp rise in the ZEW Indicator of Economic Sentiment in November,” ZEW President Achim Wambach said.

Huawei hands out bonuses

From The Associated Press: Huawei is paying its employees bonuses for helping the Chinese tech giant cope with U.S. sanctions that threaten its smartphone and other businesses. A company announcement circulated on social media said 90,000 employees will share the equivalent of US$285 million, or about US$3,100 each. Huawei’s 180,000-member workforce also will receive an extra month’s salary. The announcement told employees the bonuses were to “thank you for your efforts” since U.S. curbs on technology sales to Huawei were announced in May.”

Also ...

Required Reading

Semafo faces criticism

Montreal gold miner Semafo Inc. is coming under criticism for ineffective security measures in Burkina Faso after one of the worst terrorist attacks on employees of a Canadian company. Said chief executive officer Benoit Desormeaux: “Myself and most of our senior management team are in-country ensuring all those affected are getting the support they require. Our priority continues to be their safety, security and well being.” Nicolas Van Praet and Geoffrey York report.

Also-rans

By this measure, Ian McGugan argues, even Canada’s most prosperous provinces are also-rans vs. most U.S. states.

Disappointing bonuses

Canada’s bank-owned investment dealers will cut bonus cheques to employees in the next few weeks. And, Andrew Willis writes, it’s going to be a disappointing experience at most brokerage houses and a wake-up call for Bank of Nova Scotia, where strong credit relationships failed to translate into more lucrative assignments in stock sales and merger advice in the recently concluded fiscal year.